INTRODUCTION

Tribunal is a quasi-judicial institution that is set up to deal with problems such as resolving administrative or tax-related disputes. It performs a number of functions like adjudicating disputes, determining rights between contesting parties, making an administrative decision, reviewing an existing administrative decision and so forth.

Need of Tribunal

- To overcome the situation that arose due to the pendency of cases in various Courts, domestic tribunals and other Tribunals have been established under different Statutes, hereinafter referred to as the Tribunals.

- The Tribunals were set up to reduce the workload of courts, to expedite decisions and to provide a forum which would be manned by lawyers and experts in the areas falling under the jurisdiction of the Tribunal.

- The tribunals perform an important and specialised role in justice mechanism. They take a load off the already overburdened courts. They hear disputes related to the environment, armed forces, tax and administrative issues.

Constitutional Provisions

Tribunals were not part of the original constitution, it was incorporated in the Indian Constitution by 42nd Amendment Act, 1976.

- Article 323-A deals with Administrative Tribunals.

- Article 323-B deals with tribunals for other matters.

- Under Article 323 B, the Parliament and the state legislatures are authorised to provide for the establishment of tribunals for the adjudication of disputes relating to the following matters:

- Taxation

- Foreign exchange, import and export

- Industrial and labour

- Land reforms

- Ceiling on urban property

- Elections to Parliament and state legislatures

- Food stuff

- Rent and tenancy rights

Articles 323 A and 323 B differ in the following three aspects:

- While Article 323 A contemplates the establishment of tribunals for public service matters only, Article 323 B contemplates the establishment of tribunals for certain other matters (mentioned above).

- While tribunals under Article 323 A can be established only by Parliament, tribunals under Article 323 B can be established both by Parliament and state legislatures with respect to matters falling within their legislative competence.

- Under Article 323 A, only one tribunal for the Centre and one for each state or two or more states may be established. There is no question of the hierarchy of tribunals, whereas under Article 323 B a hierarchy of tribunals may be created.

Article 262: The Indian Constitution provides a role for the Central government in adjudicating conflicts surrounding inter-state rivers that arise among the state/regional governments.

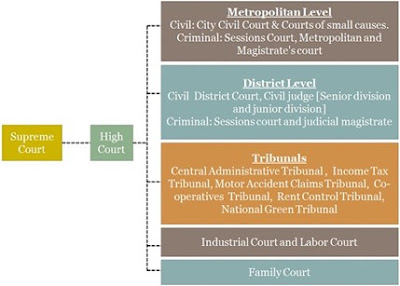

n Tribunals in India

Administrative Tribunals

Administrative Tribunals was set-up by an act of Parliament, Administrative Tribunals Act, 1985. It owes its origin to Article 323 A of the Constitution. It adjudicates disputes and complaints with respect to recruitment and conditions of service of persons appointed to the public service and posts in connection with the affairs of the Union and the States.

- The Central Government establishes an administrative tribunal called the Central Administrative Tribunal (CAT).

- The Central Government may, upon receipt of a request in this behalf from any State Government, establish an administrative tribunal for such State employees.

- Two or more States might ask for a joint tribunal, which is called the Joint Administrative Tribunal (JAT), which exercises powers of the administrative tribunals for such States.

- There are tribunals for settling various administrative and tax-related disputes, including Central Administrative Tribunal (CAT), Income Tax Appellate Tribunal (ITAT), Customs, Excise and Service Tax Appellate Tribunal (CESTAT), National Green Tribunal (NGT), Competition Appellate Tribunal (COMPAT) and Securities Appellate Tribunal (SAT), among others.

Central Administrative Tribunal

It has jurisdiction to deal with service matters pertaining to the Central Government employees or of any Union Territory, or local or other government under the control of the Government of India, or of a corporation owned or controlled by the Central Government. The CAT was set-up on 1 November 1985. It has 17 regular benches, 15 of which operate at the principal seats of High Courts and the remaining two at Jaipur and Lucknow. These Benches also hold circuit sittings at other seats of High Courts. The tribunal consists of a Chairman, Vice-Chairman and Members.The Members are drawn, both from judicial as well as administrative streams so as to give the Tribunal the benefit of expertise both in legal and administrative spheres. The appeals against the orders of an Administrative Tribunal shall lie before the Division Bench of the concerned High Court.

State Administrative Tribunal

- Article 323 B empowers the state legislatures to set up tribunals for various matters like levy, assessment, collection and enforcement of any of the tax matters connected with land reforms covered by Article 31A.

Water Disputes Tribunal

The Parliament has enacted Inter-State River Water Disputes (ISRWD) Act, 1956 have formed various Water Disputes Tribunal for adjudication of disputes relating to waters of inter-State rivers and river valleys thereof.

Standalone Tribunal: The Inter-State River Water Disputes (Amendment) Bill, 2019 is passed by Parliament for amending the existing ISRWD Act, 1956 to constitute a standalone Tribunal to remove with the need to set up a separate Tribunal for each water dispute which is invariably a time-consuming process.

Armed Forces Tribunal (AFT)

It is a military tribunal in India. It was established under the Armed Forces Tribunal Act, 2007. It has provided the power for the adjudication or trial by AFT of disputes and complaints with respect to commission, appointments, enrolments and conditions of service in respect of persons subject to the Army Act, 1950, The Navy Act, 1957 and the Air Force Act, 1950. Besides the Principal Bench in New Delhi, AFT has Regional Benches at Chandigarh, Lucknow, Kolkata, Guwahati, Chennai, Kochi, Mumbai and Jaipur. Each Bench comprises of a Judicial Member and an Administrative Member.

The Judicial Members are retired High Court Judges and Administrative Members are retired Members of the Armed Forces who have held the rank of Major General/ equivalent or above for a period of three years or more, Judge Advocate General (JAG), who have held the appointment for at least one year are also entitled to be appointed as the Administrative Member.

National Green Tribunal (NGT)

The National Environment Tribunal Act, 1995 and National Environment Appellate Authority Act, 1997 were found to be inadequate giving rise to demand for an institution to deal with environmental cases more efficiently and effectively.

The Law Commission in its 186th Report suggested multi-faceted Courts with judicial and technical inputs referring to the practice of environmental Courts in Australia and New Zealand. As a result NGT was formed as a special fast-track, quasi-judicial body comprising of judges and environment experts to ensure expeditious disposal of cases.

The National Green Tribunal was established in 2010 under the National Green Tribunal Act 2010 as a statutory body. It was setup for effective and expeditious disposal of cases relating to environmental protection and conservation of forests and other natural resources. It also ensures enforcement of any legal right relating to environment and giving relief and compensation for damages to persons and property.

Income Tax Appellate Tribunal

Section 252 of the Income Tax Act, 1961 provides that the Central Government shall constitute an Appellate Tribunal consisting of many Judicial Members and Accountant members as it thinks fit to exercise the powers and functions conferred on the Tribunal by the Act.

Characteristics of Administrative Tribunals

- Administrative Tribunal is a creation of a statute.

- An Administrative Tribunal is vested in the judicial power of the State and thereby performs quasi-judicial functions as distinguished from pure administrative functions.

- Administrative Tribunal is bound to act judicially and follow the principles of natural justice.

- It is required to act openly, fairly and impartially.

- An Administrative Tribunal is not bound by the strict rules of procedure and evidence prescribed by the civil procedure court.

Merging of Tribunals

The Finance Act of 2017 merged eight tribunals according to functional similarity. The list of the tribunals that have been merged are given below:

- The Employees Provident Fund Appellate Tribunal with The Industrial Tribunal.

- The Copyright Board with The Intellectual Property Appellate Board .

- The Railways Rates Tribunal with The Railways Claims Tribunal.

- The Appellate Tribunal for Foreign Exchange with The Appellate Tribunal (Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act, 1976.

- The National Highways Tribunal with The Airport Appellate Tribunal.

- The Cyber Appellate Tribunal and The Airports Economic Regulatory Authority Appellate Tribunal with The Settlement and Appellate Tribunal (TDSAT) .

The Competition Appellate Tribunal with the National Company Law Appellate Tribunal. Difference Between Tribunal and Court

Administrative Tribunals and Ordinary Courts both deal with the disputes between the parties which affects the rights of the subjects.Administrative Tribunal is not a court.

- A court of law is a part of the traditional judicial system whereby judicial powers are derived from the state.

- An Administrative Tribunal is an agency created by the statute and invested with judicial power.

- The Civil Courts have judicial power to try all suits of a civil nature unless the cognizance is expressly or impliedly barred.

- Tribunal is also known as the Quasi-judicial body. Tribunals have the power to try cases of special matter which are conferred on them by statutes

- Judges of the ordinary courts of law are independent of the executive in respect of their tenure, terms and conditions of service etc. Judiciary is independent of Executive.

- Tenure, terms and conditions of the services of the members of Administrative Tribunal are entirely in the hands of Executive (government).

- The presiding officer of the court of law is trained in law.

- The president or a member of the Tribunal may not be trained as well in law. He may be an expert in the field of Administrative matters.

- A judge of a court of law must be impartial who is not interested in the matter directly or indirectly.

- An Administrative Tribunal may be a party to the dispute to be decided by it.

- A court of law is bound by all the rules of evidence and procedure.

- An Administrative Tribunal is not bound by rules but bound by the principles of nature of Justice.

- Court must decide all questions objectively on the basis of evidence and materials on record.

- Administrative Tribunal may decide questions by taking into account departmental policy, the decision of Administrative Tribunal may be subjective rather than objective.

- A court of law can decide vires of a legislation

- Administrative Tribunal cannot do so.